Project Emerald – Report on the Drivers of Cost and Availability of Finance for Residential Development

The residential development finance landscape in Ireland is experiencing a period of significant change, with notable challenges arising from various factors such as equity constraints, debt market competition, planning concerns, and viability issues. Here, Kelly Bradshaw Dalton have summarised the main findings of this report where it delves into the intricacies of the Irish market in an effort to uncover the primary drivers of cost and availability of finance for residential development, with a particular focus on the impacts of global macroeconomic headwinds and a deteriorating interest rate environment on both apartment and housing development segments.

Key findings:

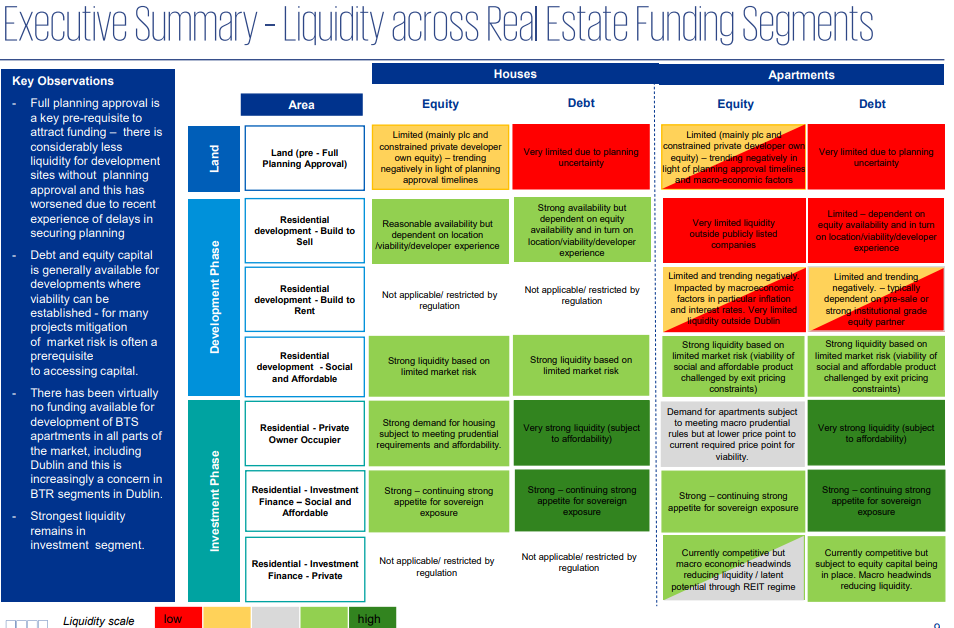

- Period of significant change in funding markets for residential development, with differentiated landscape for apartments and housing.

- Reasonable access to capital for housing projects, but significant funding challenges for more capital-intensive apartment development.

- Deteriorating interest rate environment and construction price inflation contributing to reduced funding availability for apartment development.

- Equity constraints prevalent in the Irish developer community, resulting in heavy reliance on transient international private equity and increased funding costs.

- Limited competition in Ireland’s debt market, leading to higher risk adjusted funding costs in some lending segments and limited debt financing options for certain projects.

- Worsening viability challenges in the residential development sector, most significantly for high-density apartment development, driven by high construction costs, planning density requirements, inflation, and interest rate-induced softening in valuation yields.

- Planning factors, such as pressing for higher density development, increase delivery costs, impacting project viability and funding availability.

- Increased uncertainty in the planning system due to prevalence of judicial reviews and elongated planning timelines, resulting in reduced capital available for funding sites through planning.

- Strong market appetite for financing government-supported social and affordable delivery, but evidence suggests the volume of new activity is slowing down.

- Construction cost inflation over the last 18 months has led to an increasing number of projects becoming unfeasible within permitted social and affordable pricing models.

- Ongoing review of social and affordable pricing models and potential pivot towards increased forward funding could enhance cost and availability of funding for social and affordable delivery, better positioning the sector in the medium term.